Janak Merchant

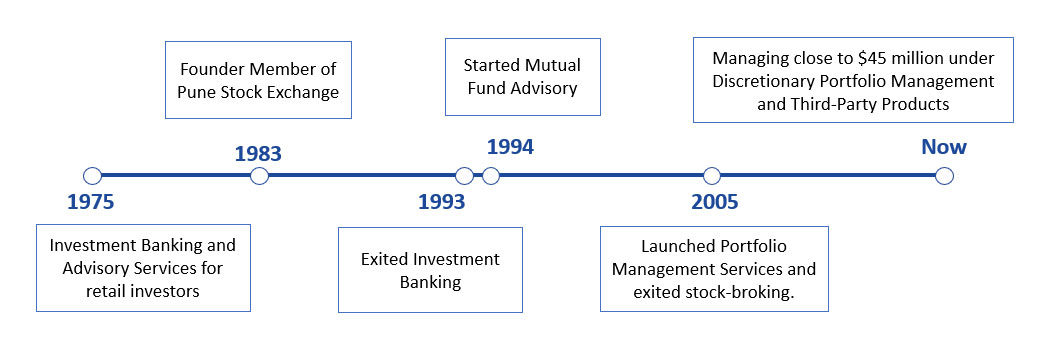

Our founder, Mr. Janak Merchant, started in the seventies with the objective to create an equity investment culture in the city of Pune. He founded the Pune Stock Exchange in 1983.The business started as a traditional stock-broking firm and investment-banking business through the IPO frenzy that gripped India in the 1980s. The business survived, evolved and prospered despite the bubble of 1992, the NBFC collapse and the UTI-64 debacle. Without losing focus, we helped clients navigate through treacherous waters of the financial markets.

In 1999 the second generation – Mr. Jaideep Merchant – joined the business after completing his Chartered Accountancy. He is our Chief Investment Officer (CIO).

The dotcom collapse added the global dimension to investing in Indian equity markets. Our CIO, in year 2006, became a charter-holder of the US-based CFA Institute.

The management decided that the transaction-oriented, broking business was not the right way to provide value for clients. The inherent conflict-of-interest in generating revenue from transactions was against the objective of long-term wealth generation – which involves being patient and doing fewer transactions.

An emotionally and financially difficult decision – a transition to an asset management business – was made in year 2005 and we launched our Portfolio Management Service.

Our clients are individuals and amongst them some families for whom we have been advising them for three generations now.

Our Journey

Why Us

Our primary objective is to generate returns over time, and all investment decisions are taken with at least a five-year view. We have a proven track record of beating indices over the long-term.

- Cumulative experience of the fund management team serves as an elephantine memory to better understand inflexion points on market cycles, corporate governance standards of various companies, promoters’ treatment of minority-shareholders, evolving regulatory environment and clients’ expectations.

- Most members of the organisation have more than a decade’s experience in their respective roles.

- Our clients have been alongside us over many market-cycles; and the newer clients who entrust us to manage their monies, experience that the patient fund management style eventually pays-off.

- Janak Merchant Securities Private Limited, its founders, promoters and key employees have invested most of their savings in same securities as those that are held by clients.

- We have always been ahead of regulations when it comes to investors’ interests. Our Portfolio Management service has never charged any ENTRY or EXIT LOAD. There is no commitment on part of the client to lock-in their capital. As it is important for the prospective client to do their due diligence on the fund manager, it is equally important for us to ensure that the client is investing because they have bought in to our investment style and investment framework.

- We are not running on a treadmill to garner capital or perform month-to-month. This allows us to take a longer-term view while constructing a portfolio and not be influenced by the current momentum sectors. Owing to our long-term approach, we get a larger set of investment ideas which are highly undervalued and not popular, and over time turn out to be excellent investments.

- Our consultation with existing and prospective client’s factors-in whether the client is taking risk beyond their appetite and economic circumstances. Clients may be advised to withdraw money or prospective clients may be turned down – both of which may be detrimental to our interests. We value longevity in a client relationship rather than earning higher fees in the near-term.